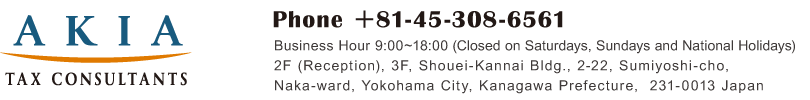

AKIA TAX CONSULTANTS

Support services for documentation related to

BEPS Project

Based on the recommendations of OECDfs Base Erosion and Profit Shifting (gBEPSh) Project, the Act on transfer pricing documentation has developed in Japan@(Outline of the

Revision of the Transfer Pricing Documentation (NTA June

2016) , which can not be ignored even for small and medium-sized foreign-affiliated corporations in Japan.

Revision of the Transfer Pricing Documentation (NTA June

2016) , which can not be ignored even for small and medium-sized foreign-affiliated corporations in Japan.

Even though the scale of business in Japan is small, if a group's consolidated total revenue amount is 100 billion yen or more, predetermined notification and reporting are necessary.

AKIA TAX CONSULTANTS has provided accounting, domestic and international taxation and personnel labor services, etc. to small and medium-sized foreign-affiliated corporations up to now, but in

addition to these, we also provide support services for documentation required by National Tax

Agency related to BEPS Project.

Notification for Ultimate Parent Entity, Master File, Local File and Country-by-Country Report (CbCR)

prescribed in the documentation system on transfer pricing taxation in Japan are briefly described as

follows;

- Notification for Ultimate Parent Entity

Notification to inform National Tax Agency in advance of information on the Ultimate Parent Entity of

the group

- Master File

Overview of the groupfs business activities

- Local File

Explanation whether Controlled Transactions are performed at Armfs Length Price (ALP)

- CbCR

List of financial and non-financial information on a tax jurisdiction-by tax jurisdiction basis

For details, please click below.

AKIA TAX CONSULTANTS has provided accounting, domestic and international taxation and personnel labor services, etc. to small and medium-sized foreign-affiliated corporations up to now, but in

addition to these, we also provide support services for documentation required by National Tax

Agency related to BEPS Project.

Notification for Ultimate Parent Entity, Master File, Local File and Country-by-Country Report (CbCR)

prescribed in the documentation system on transfer pricing taxation in Japan are briefly described as

follows;

- Notification for Ultimate Parent Entity

Notification to inform National Tax Agency in advance of information on the Ultimate Parent Entity of

the group

- Master File

Overview of the groupfs business activities

- Local File

Explanation whether Controlled Transactions are performed at Armfs Length Price (ALP)

- CbCR

List of financial and non-financial information on a tax jurisdiction-by tax jurisdiction basis

For details, please click below.

We will provide detailed services tailored to the needs of your company.

You may have various questions such as whether there is no problem even if the deadline of

submission has passed and whether the volume and the degree of detail is not known.

First of all, please feel free to consult us.

You may have various questions such as whether there is no problem even if the deadline of

submission has passed and whether the volume and the degree of detail is not known.

First of all, please feel free to consult us.

Strength of AKIA TAX CONSULTANTS

AKIA TAX CONSULTANTS K.K. is an accounting firm providing tax and accounting services primarily

to foreign affiliated companies.

AKIA is an all-around professional firm affiliated with certified tax accountant, licensed labor

consultant and licensed solicitor.

Foreign affiliated companies can enjoy our complete service for tax declaration/accounting/payroll/

social insurances/bank transfer/setting up of enterprises/VISA procedures/approvals and licenses etc. so that you can focus on your business, while we take care of everything else.

to foreign affiliated companies.

AKIA is an all-around professional firm affiliated with certified tax accountant, licensed labor

consultant and licensed solicitor.

Foreign affiliated companies can enjoy our complete service for tax declaration/accounting/payroll/

social insurances/bank transfer/setting up of enterprises/VISA procedures/approvals and licenses etc. so that you can focus on your business, while we take care of everything else.